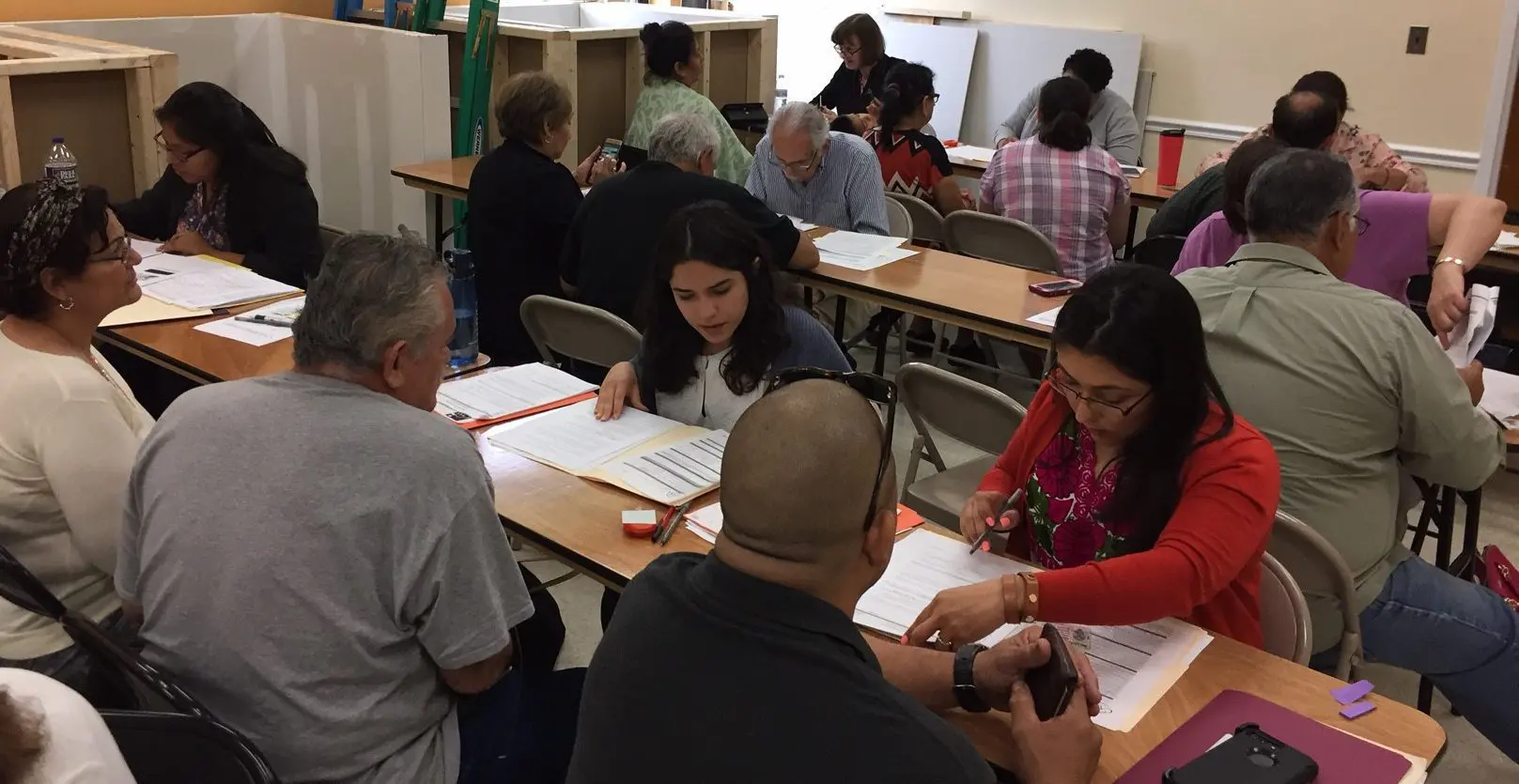

CASA operates an integrated program of financial literacy, naturalization, and legal services.

Studies show that integrated services work. While providing naturalization application assistance, civics courses, legal support, and English instruction, CASA provides clients with financial education on topics such as:

- Developing a household budget and establishing savings

- Buying a home

- Naturalization fees affordability

- Credit counseling

CASA provides individual and group-based financial education and assistance that includes:

- Individual financial counseling

- Tax preparation assistance

- Workshops on issues such as obtaining identification documents, opening a bank account, writing a check, using a debit card, debt analysis, financial planning, and obtaining and improving one’s credit score..

- Access to micro-loans and fee waiver applications for immigration processes.

We are proud to count on a number of partners who help community members cope with their financial needs. Some of those partners are:

|

|

|

|

|

|

|

|

|

|

|

|

|

We also help people with homeownership.

CreditSmart® 12-Module Financial Education Curriculum – No CertificateGet Smart About Credit and Homeownership Today! Utilize the CreditSmart consumer financial education online curriculum if you are considering homeownership for the first time or currently own a home and need information on how to avoid foreclosure. This interactive educational curriculum – available in English and Spanish – will teach you how to achieve your financial and homeownership goals.

IMPORTANT NOTE: You WILL NOT RECEIVE A CERTIFICATE for this online course. If you are a first-time homebuyer who needs a certificate to pass the homebuyer education requirement for Home Possible mortgages, go to the Freddie Mac Steps to Homeownership online tutorial here. |

||